Open Banking, API-Schnittstelle, XS2A

Requirement:

Automated retrieval of transaction data for further processing in the back office.

Solution:

Development of a service for the automated retrieval of account transactions, comparison with orders from a sales system and release of the associated orders. The newly developed application retrieves the transaction data - depending on the account-holding bank - via FinTS, EBICS or an API (XS2A) provided by the respective bank, and processes them automatically.

Background information:

Open banking means the use of bank services via specially created APIs (application interfaces). Third parties (e.g. account information services) can, with the consent of the respective end customer, view the customer's account transfer data electronically and process it as part of their own processes.

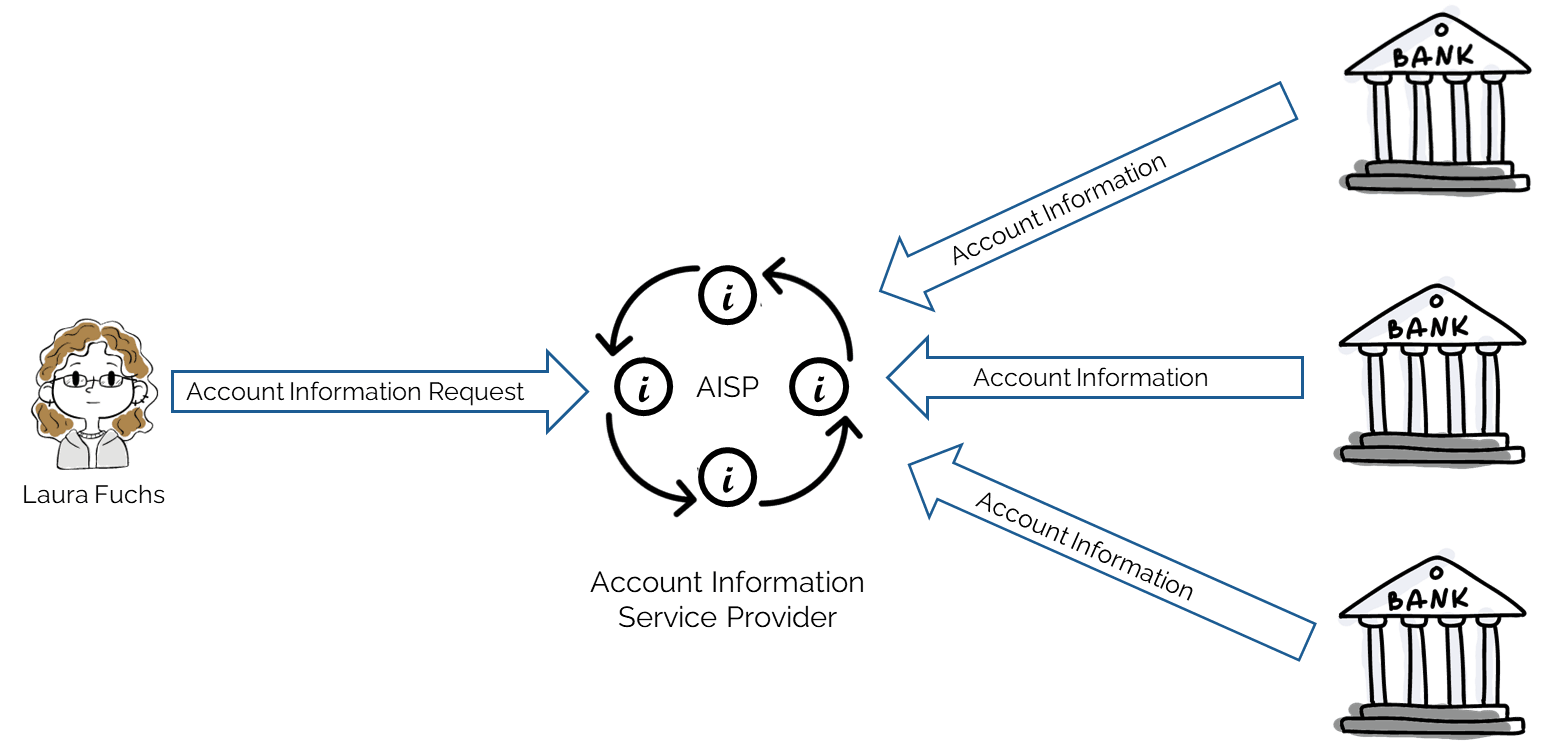

AISP/KID

Account Information Service Provider/Kontoinformationsdienste

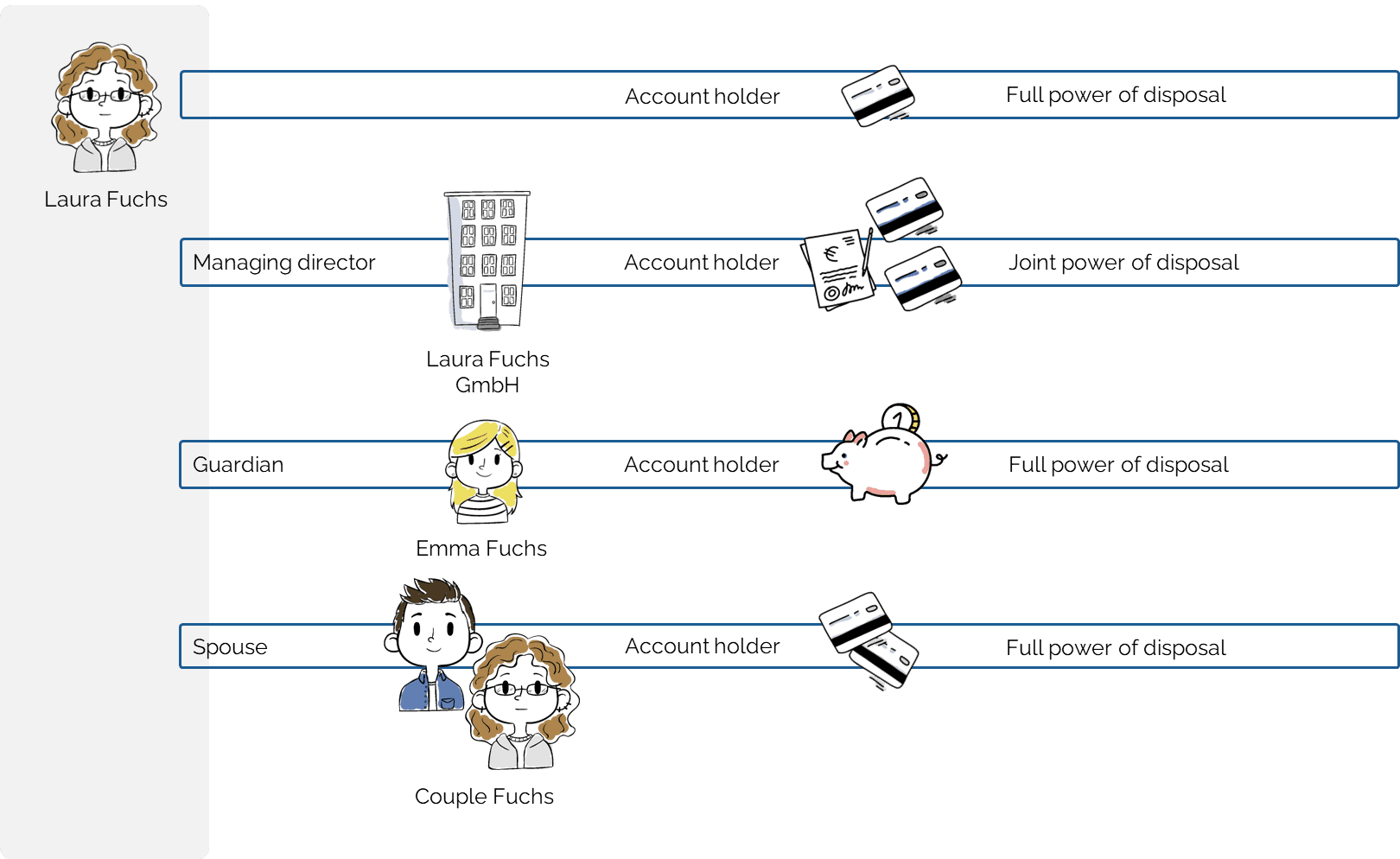

So-called Account Information Service Providers access the customer's account information, which is stored at the customer's bank, on behalf of the customer. Depending on the provider, the information collected is analysed and processed further, for example as part of credit application processes.

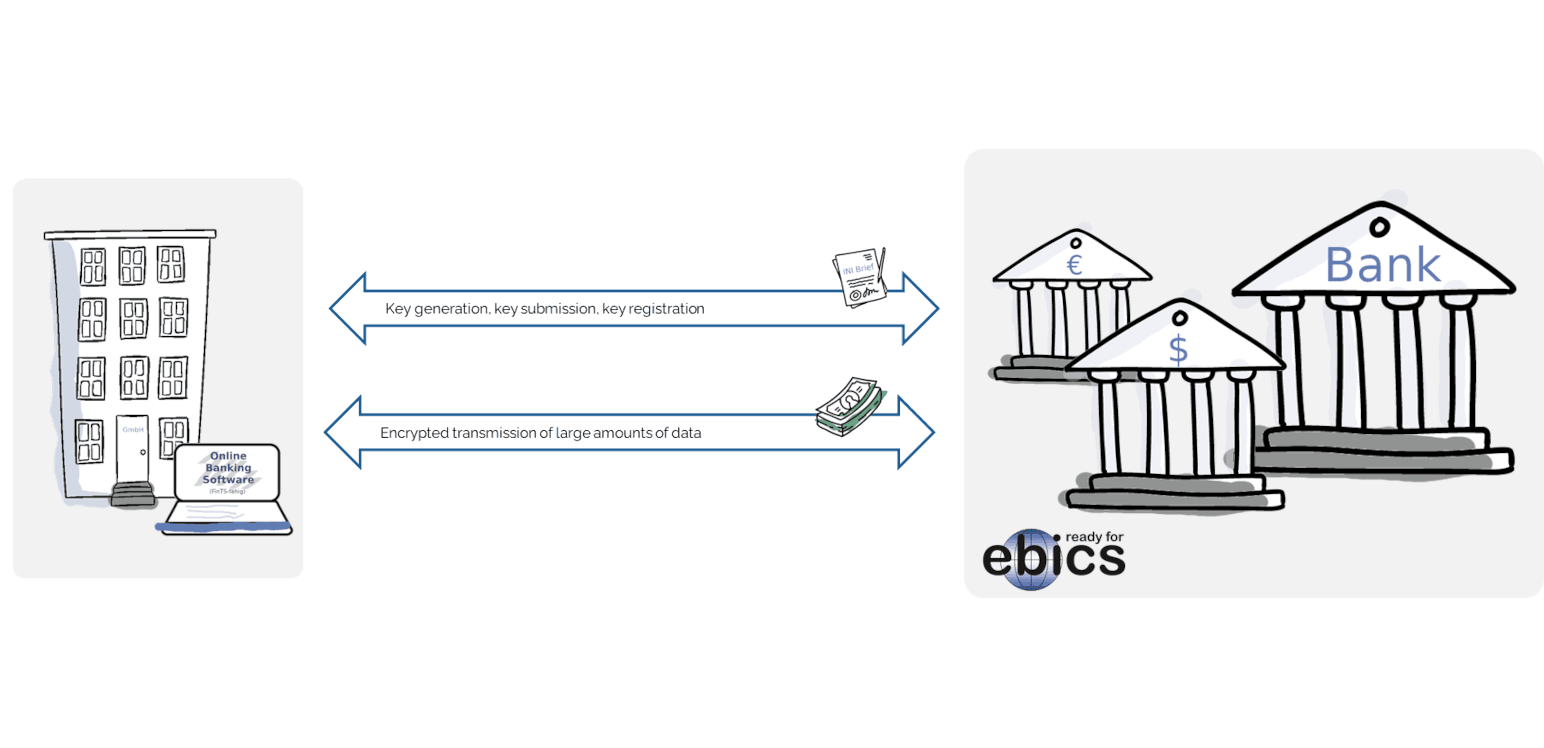

EBICS

Electronic Banking Internet Communication Standard

Corporate customers demand technologically advanced standard products that can be used for multi-bank payment transactions. Multi-bank capability, i.e. the accessibility of all banks, is essential for corporate customers, as this is the only way to transmit payment orders to several banks at low cost. Payment transactions not only include transfers and direct debits, but also cover the entire spectrum of cash management for corporate customers.

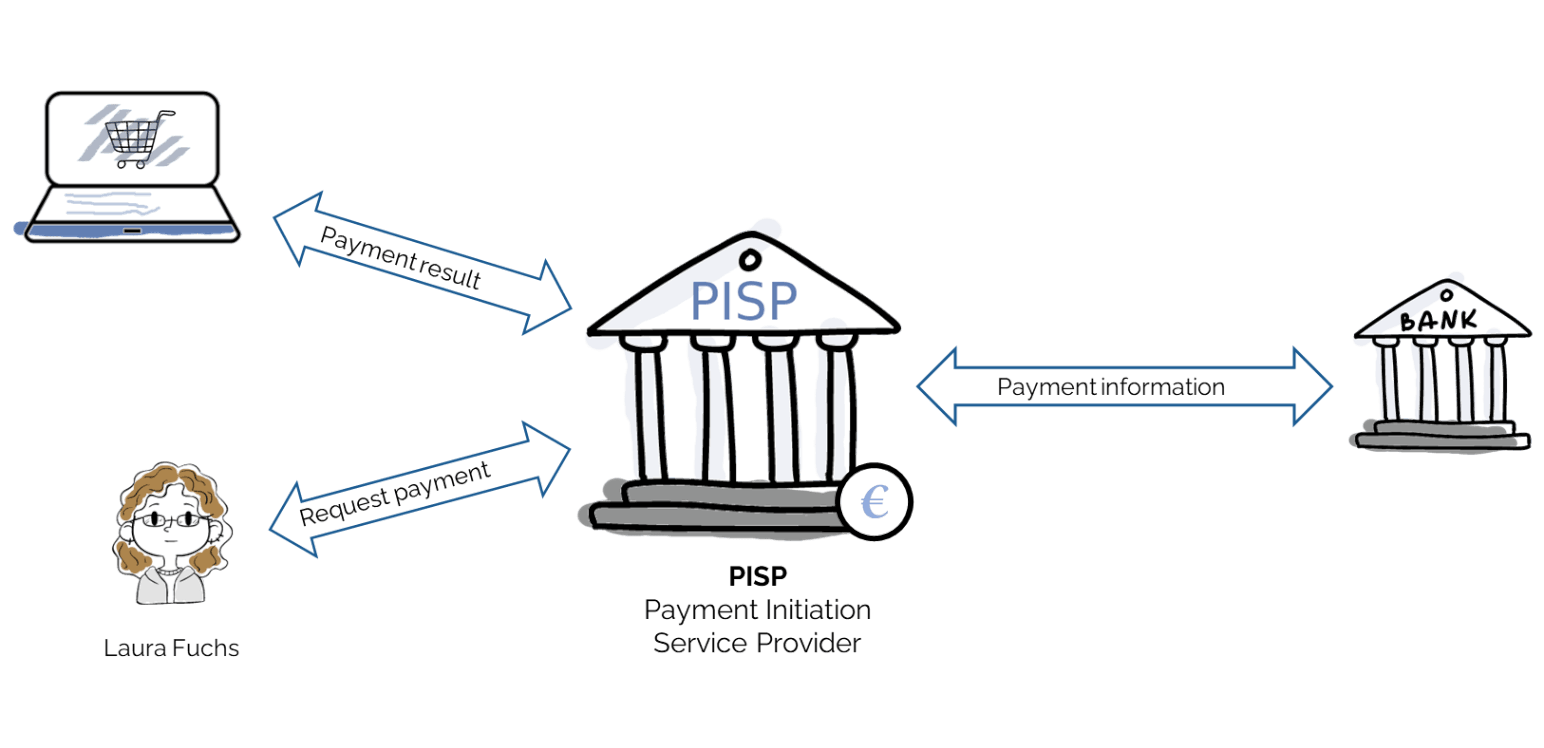

PISP/ZAD

Payment Initiation Service Provider/ Zahlungsauslösedienste

So-called payment initiation service providers also get access to the customer's bank account on behalf of the customer. In contrast to account information services, however, they are authorised to initiate transactions on the customer's account.

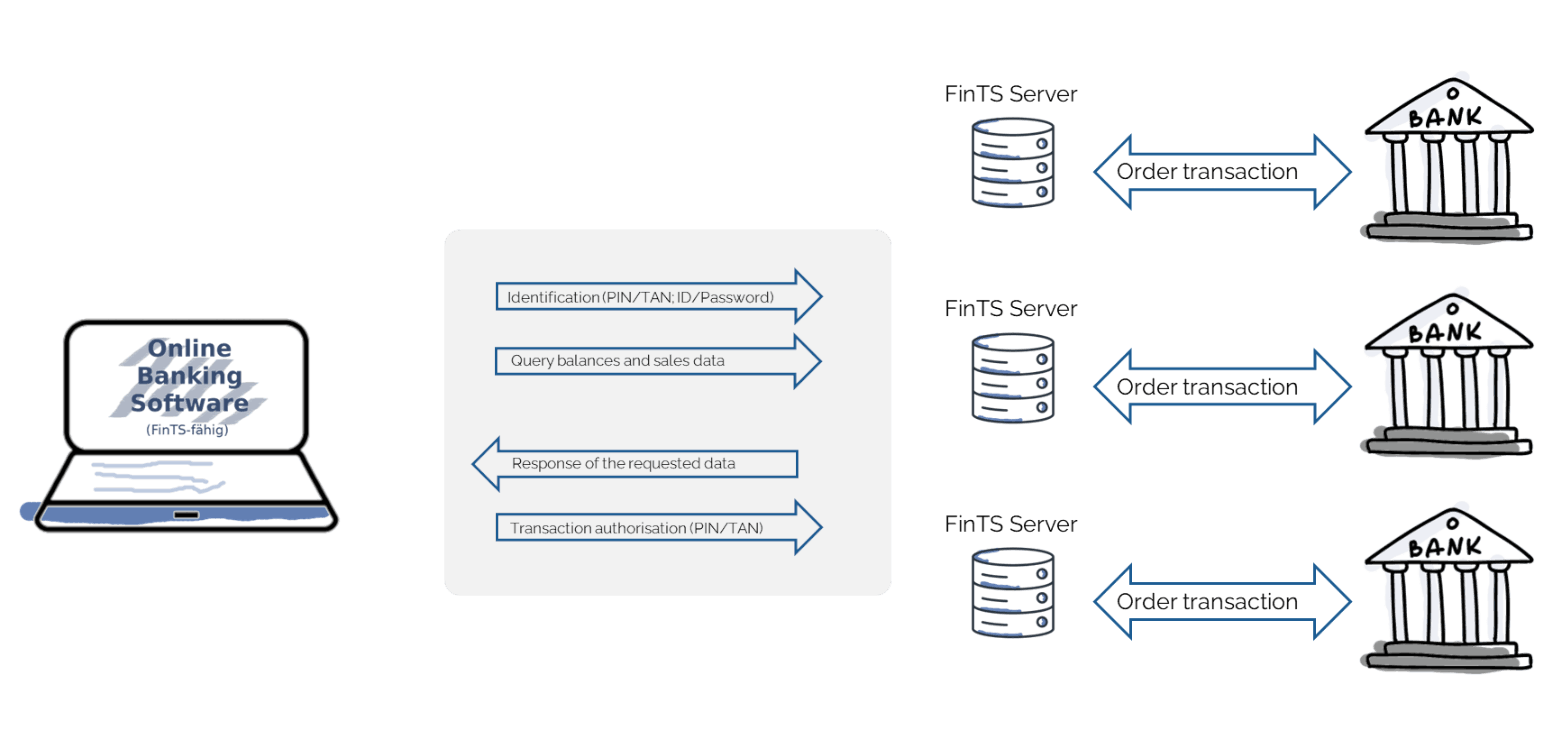

FinTS

Financial Transaction Services

FinTS is a German standard for the operation of online banking. FinTS is a further development of the HBCI online banking standard. The purpose of FinTS is to standardise the connection between bank customers and the credit institution, particularly with regard to multi-bank capability.